Understanding Health Insurance Options: Your Path to Financial and Medical Security

Health insurance is a crucial aspect of securing your well-being and financial stability. With various options available, navigating the landscape of health insurance can be overwhelming. In this comprehensive guide, we’ll break down the key considerations and help you make informed decisions about your health coverage.

1. Assess Your Healthcare Needs

Before diving into the world of health insurance, assess your healthcare needs. Consider factors such as your medical history, current health status, and any pre-existing conditions. This evaluation will guide you in choosing a plan that aligns with your specific requirements.

2. Types of Health Insurance Plans

Health insurance plans come in different types, each with its features and cost structures. Common types include Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Exclusive Provider Organization (EPO), and Point of Service (POS). Understanding the nuances of each plan will empower you to select the one that suits your lifestyle and preferences.

3. Coverage and Benefits

Carefully examine the coverage and benefits offered by each plan. Check for inpatient and outpatient services, prescription drug coverage, preventive care, and maternity benefits. Understanding the extent of coverage ensures that you are adequately protected against potential medical expenses.

4. Network Providers

Most health insurance plans have a network of healthcare providers. Confirm that your preferred doctors, specialists, and hospitals are within the plan’s network. Out-of-network services may result in higher costs, so being aware of network coverage is essential.

5. Deductibles, Premiums, and Copayments

Understand the financial aspects of your health insurance plan, including deductibles, premiums, and copayments. A deductible is the amount you pay before your insurance kicks in, while premiums are regular payments to maintain coverage. Copayments are fixed amounts you pay for specific services. Balancing these factors is crucial for managing your budget effectively.

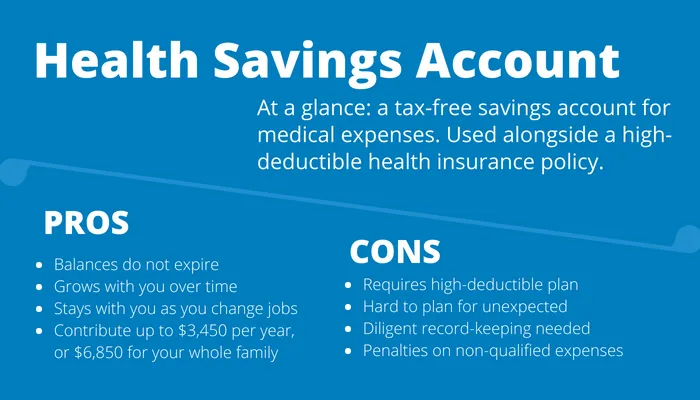

6. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

Explore options like HSAs and FSAs, which offer tax advantages for healthcare expenses. HSAs are linked to high-deductible health plans and allow you to save money tax-free for medical costs. FSAs are employer-sponsored accounts that let you set aside pre-tax dollars for qualified medical expenses.

7. Consider Catastrophic Health Insurance

If you’re young and healthy, catastrophic health insurance may be a viable option. These plans have low premiums but high deductibles and are designed to protect you in case of major health events.

8. Review the Fine Print

Carefully read the terms and conditions of each health insurance plan. Pay attention to exclusions, limitations, and any waiting periods for specific services. Understanding the fine print ensures there are no surprises when you need to use your insurance.

Conclusion

Choosing the right health insurance plan is a significant step toward securing your health and financial well-being. By evaluating your needs, understanding plan types, and considering key factors like coverage, costs, and network providers, you can make an informed decision that aligns with your unique circumstances. Don’t hesitate to seek guidance from insurance professionals to ensure you choose a plan that provides the necessary protection for you and your loved ones. Your journey to financial and medical security starts with a well-informed choice in health insurance.